What is sale and leaseback of assets?

A sale and leaseback of assets is an asset-based financing model, where a company sells their fixed assets to a company and then leases them back for a fixed monthly fee, over an agreed term.

This type of financing offers an alternative to traditional financing, allowing businesses to free up capital they have already invested in assets and maximise the value of their existing technology, without losing the use of those assets.

Unlike a loan, which would be shown on the company’s balance sheet as a debt, a sale and leaseback transaction can bring down liability and increase current assets. A further benefit of this type of financing is that rates are generally more favourable than other types of borrowing.

Benefits at a glance

Removes the costs and risks of ownership of assets that were previously capital investments.

Creates additional capital budget based on currently owned assets.

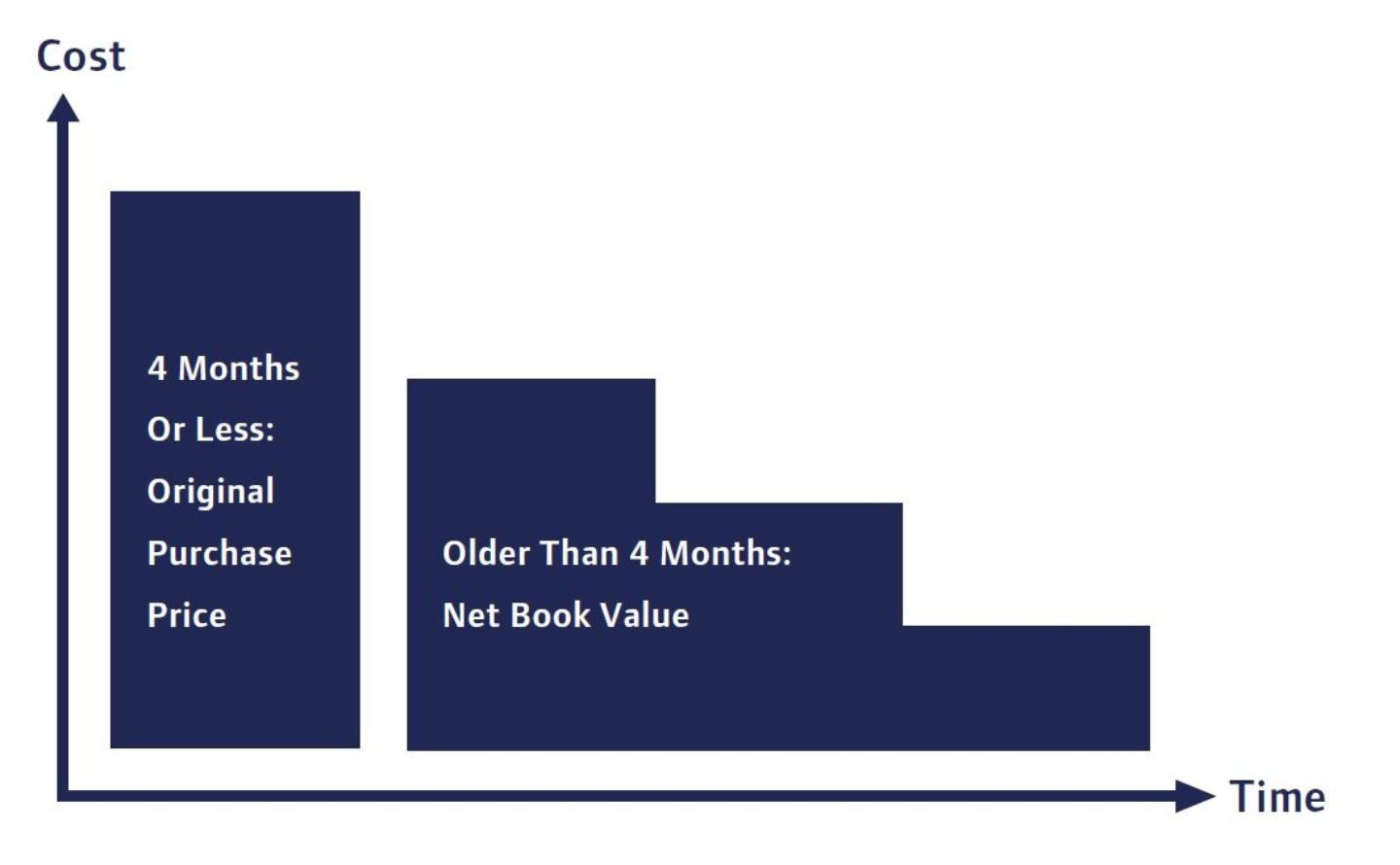

Alignment of depreciation, usage and useful life.

Generate cash.

Accelerate future projects.

Clear projection of budget with a linear rental stream.

Non-disruptive.

Portfolio transparency through our asset management system, tesma.

Provides fixed known costs throughout the term.

Staying one step ahead

In today's world, the latest gadget, invention or technological advancement always appears to be on the horizon. By utilising our sale and leaseback of assets solution, you can take advantage of our lifecycle refresh programme, ensuring your technology estate is always up to date. Furthermore, by utilising a leasing schedule, the sum of rentals will usually be lower than the capital cost of the equipment, ensuring you've not only got the latest assets but also affordability.

Sale and Leaseback FAQ's

Find out more

Discover the other solutions and services we provide