Why own when you can simply use it?

Build your tailored technology usage solution

Acquire, manage and refresh technology your way. Choose your preferred equipment, select your payment terms and bundle services in a single repayment. It's that easy. Let us show you how.

Assets

Become more agile. Keep your equipment up to date at all times and increase the speed, agility and efficiency of your company.

Financing

Optimise budget. Manage your cash flow more effectively, even with larger investment requirements, and reduce overall operating costs.

Services

Get the most out of IT. Supplement your usage model with supporting services such as asset management, sustainability solutions and data security.

"Working in partnership with CHG-MERIDIAN, we reduced procurement costs, improved processes, and optimised our cash flow, thus cutting our expenditure by an impressive 30%."

Eric Suwandinata, Global Category Manager, Vitesco Technologies GmbH

technology2use

Solving your challenges is our top priority

We carefully listen to your needs to create a customised technology usage model for your IT hardware, industrial technology, or healthcare equipment. Our solution combines assets, financing, and services tailored to you without reliance on manufacturers or banks. It's digital, global, and centralised, all from one source.

Learn how we help you achieve your goals

Each business has its own distinct needs for managing operations effectively. Business leaders are tasked with keeping up with the changing pace of technology, reducing costs, and achieving sustainability goals.

With 45 years of experience and a deep understanding of various industries, we have integrated our expertise into use cases that show how we help solve our customers' missions and how a customised usage model can enhance business outcomes. Explore our technology overview pages to discover how we can help you achieve your full potential.

IT hardware

Work digitally: The latest devices - cleverly and sustainably financed. Use cutting-edge IT equipment as a driver for greater efficiency and innovation, and a magnet for a satisfied team.

IT hardware

Work digitally: The latest devices - cleverly and sustainably financed. Use cutting-edge IT equipment as a driver for greater efficiency and innovation, and a magnet for a satisfied team.

Industrial technology

Leverage potential: Easily manage your production, warehouse and logistics equipment. Monitor your diverse technology across all countries and keep total costs under control.

Industrial technology

Leverage potential: Easily manage your production, warehouse and logistics equipment. Monitor your diverse technology across all countries and keep total costs under control.

Healthcare equipment

Stay fit for the future: intelligent use of cutting-edge medical technology and hospital IT. Position yourself successfully against the competition with modern technology and counter cost pressure with clever savings

Healthcare equipment

Stay fit for the future: intelligent use of cutting-edge medical technology and hospital IT. Position yourself successfully against the competition with modern technology and counter cost pressure with clever savings

Our promise: easy usage & global scalability

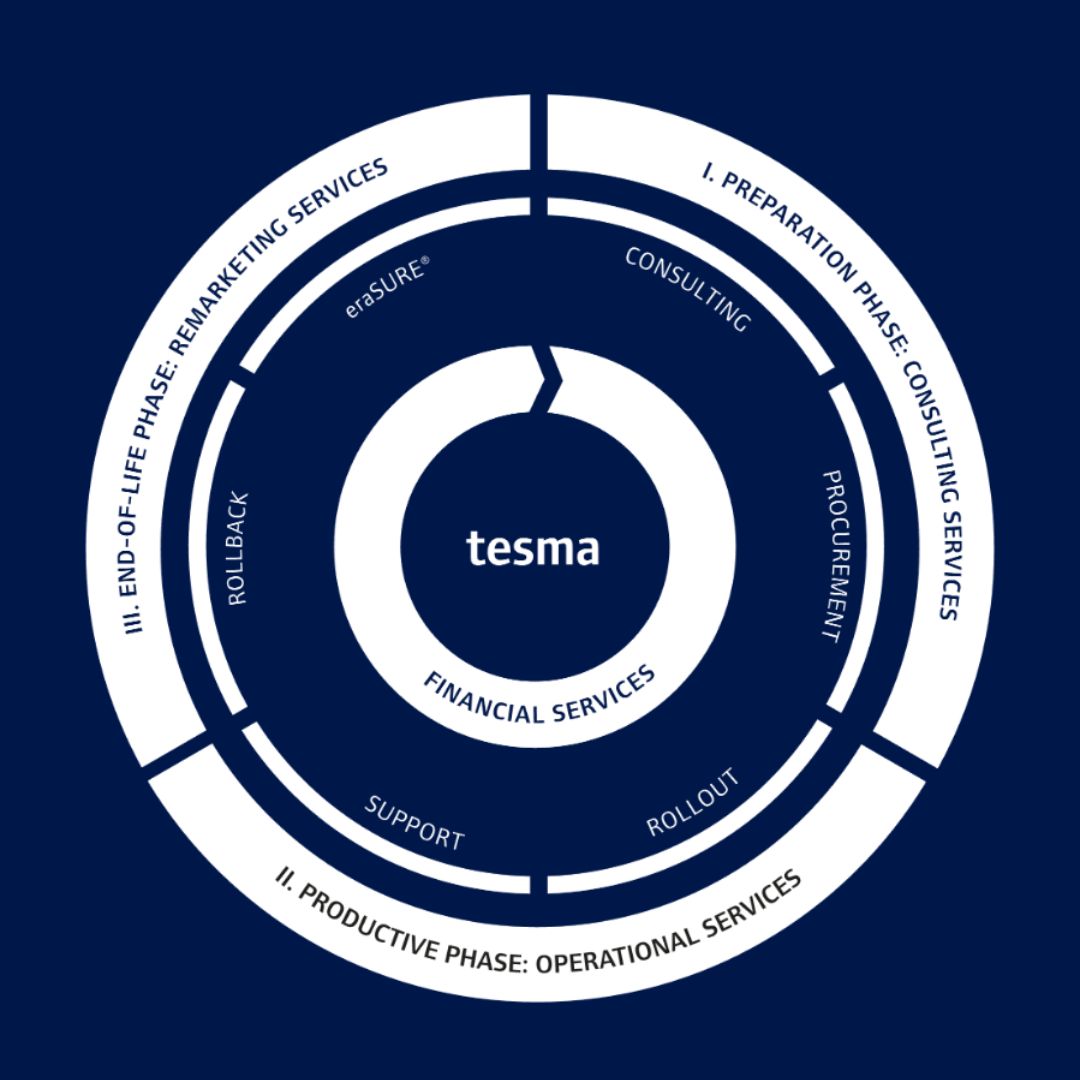

I. Preparation phase

Consulting: We will create a customised catalogue of services together with you. If needed, we will support you in the tendering process for services. You can integrate internal services as well as preferred partners into your project as desired.Procurement: For equipment procurement, you have maximum flexibility. Orders can be centralised or decentralised (OCI, Manufacturer Shop Connection), thanks to our hardware and manufacturer-independent approach.

II. Productive phase

Rollout: We assist in implementing service packages from your selected partners or internal IT, with easy integration of additional services or partners later on.Support: Choose between in-house or external support services, with flexible response times (1st-3rd Level: 5-7 days or 8-24 hours). We ensure uninterrupted operations with options like Single/Double SWAP, pool variations, and insurance coverage.

III. End-of-life phase

Rollback: We tailor device retrieval to your needs: whether centralised or decentralised (end-user). You select the data erasure approach that fits you best. Remarketing: We handle sustainable remarketing on your behalf. Interested in extending the lifespan of your devices? We offer flexible duration extensions.

tesma: your key to simplified asset management

Gain full transparency throughout the asset lifecycle, ensuring transparency and insight from acquisition to disposal. With flexible management options, you can effortlessly adapt to changing needs while maintaining straightforward financial control and reporting. Easily manage and allocate costs, regardless of location, including international expenses, allowing for seamless financial management across borders. Find out more: tesma