Need to upgrade your equipment? We can help!

We are proud to support organisations in over 31 countries with custom technology financing and lifecycle management services. Enquire about support today!

Need to upgrade your equipment? We can help!

We are proud to support organisations in over 31 countries with custom technology financing and lifecycle management services. Enquire about support today!

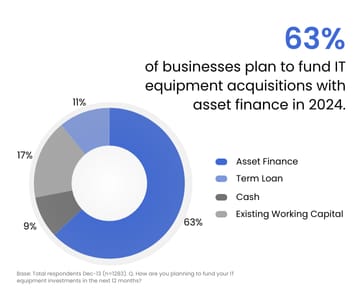

Businesses across Australia are striving to keep pace with a rapidly advancing digital landscape. Most are embracing innovative technologies and modernising their IT equipment, with investment in digital transformation key to meeting staff and customer expectations.

However, many of the same businesses are navigating cash flow constraints, an issue all too common given rising operating costs and ongoing economic uncertainty. This raises the question of how businesses balance IT investment imperatives with maintaining healthy cash flow - both crucial for success in a dynamic market environment.

Todd Fortescue, Vice President, Australia & New Zealand at CHG-MERIDIAN, says that it's clear businesses are not only looking closely at the cost of funding IT equipment in the current environment but are seeking the flexibility to upgrade as newer technology is released.

What to consider when deciding how to invest in IT equipment

As businesses weigh up whether to use cash, an operating lease or an equipment loan to secure IT equipment, there are some trade-offs that must be accounted for. This is where considering the lifecycle of IT equipment and the financial and operational needs of the business are crucial.

Purchasing equipment is more expensive

From a cost perspective, purchasing equipment outright has higher upfront expenses, which can also redirect funds away from more strategic initiatives. The total cost of ownership is also important - not just the sticker price - given maintenance and disposal of ageing technology can add significantly to expenses.

“When a business chooses to lease their equipment, there’s no upfront cost, and in the example of CHG-MERIDIAN, we invest in the residual value of the equipment, resulting in a lower equipment cost than the market value during the lease term. The cost of the technology is also spread across the term, avoiding a steep initial investment and making it easy to forecast hardware spend. Given we own the equipment, there’s also no depreciation impact for the lessee,” Todd says.

Need to upgrade your equipment? We can help!

We are proud to support organisations in over 31 countries with custom technology financing and lifecycle management services. Enquire about support today!

Need to upgrade your equipment? We can help!

We are proud to support organisations in over 31 countries with custom technology financing and lifecycle management services. Enquire about support today!

Leasing is more sustainable than purchasing

The research shows that the sustainability impact of IT purchases was another key decision driver for businesses. This can be particularly relevant when disposing of a business's technology. Here, the onus is on businesses to ensure they are responsible and reducing e-waste.

“We’re seeing more businesses adopting circular practices as part of their own plans to reduce carbon emissions and waste. This is something CHG-MERIDIAN is committed to, and at the end of a lease term, we refurbish and remarket used devices to give them a second life, avoiding ewaste and mitigating carbon impact.” Todd says.

While there is no one-size-fits-all approach to securing the technology equipment your business needs, there are many advantages to choosing an operating lease model over a chattel mortgage or purchasing model. From cost savings and cash flow improvements to keeping up to date with the latest technologies, there’s a strong case for businesses to consider.

Get in contact with us

Would you like advice that‘s personal and free of charge? Get in touch with us and discover how you can benefit from our expertise.

Contact us directly

Our team of experts are ready to help you! Get in contact now.

Discover more

Maximise your it budget and only pay for what you need

Avoid tying up capital when investing in the latest technology and benefit from a predictable payment stream, which will allow you to manage your budget better.

Maximise your it budget and only pay for what you need

Avoid tying up capital when investing in the latest technology and benefit from a predictable payment stream, which will allow you to manage your budget better.

Embracing sustainability in your it strategy

In a changing world, climate change, environmental concerns, and resource scarcity are critical issues. It's our collective responsibility to work towards sustainability. Discover how your IT strategy can contribute.

Embracing sustainability in your it strategy

In a changing world, climate change, environmental concerns, and resource scarcity are critical issues. It's our collective responsibility to work towards sustainability. Discover how your IT strategy can contribute.