Testimonials

Learn how PENNY Italia managed to upgrade 10,000 IT devices economically using flexible IT leasing.

Testimonials

Learn how PENNY Italia managed to upgrade 10,000 IT devices economically using flexible IT leasing.

Progress calls for capital spending – but budgets get in the way.

Financial decision-makers are under exceptional pressure these days. While AI, digitalization, and data security require new investment in IT, budgets are being cut, headcount reductions are being discussed, and capital commitments are becoming a risk. This is where conventional CapEx models reach their limits. Businesses looking to secure liquidity need to take a strategic view of financing.

Facts (Darstellung wie unten):

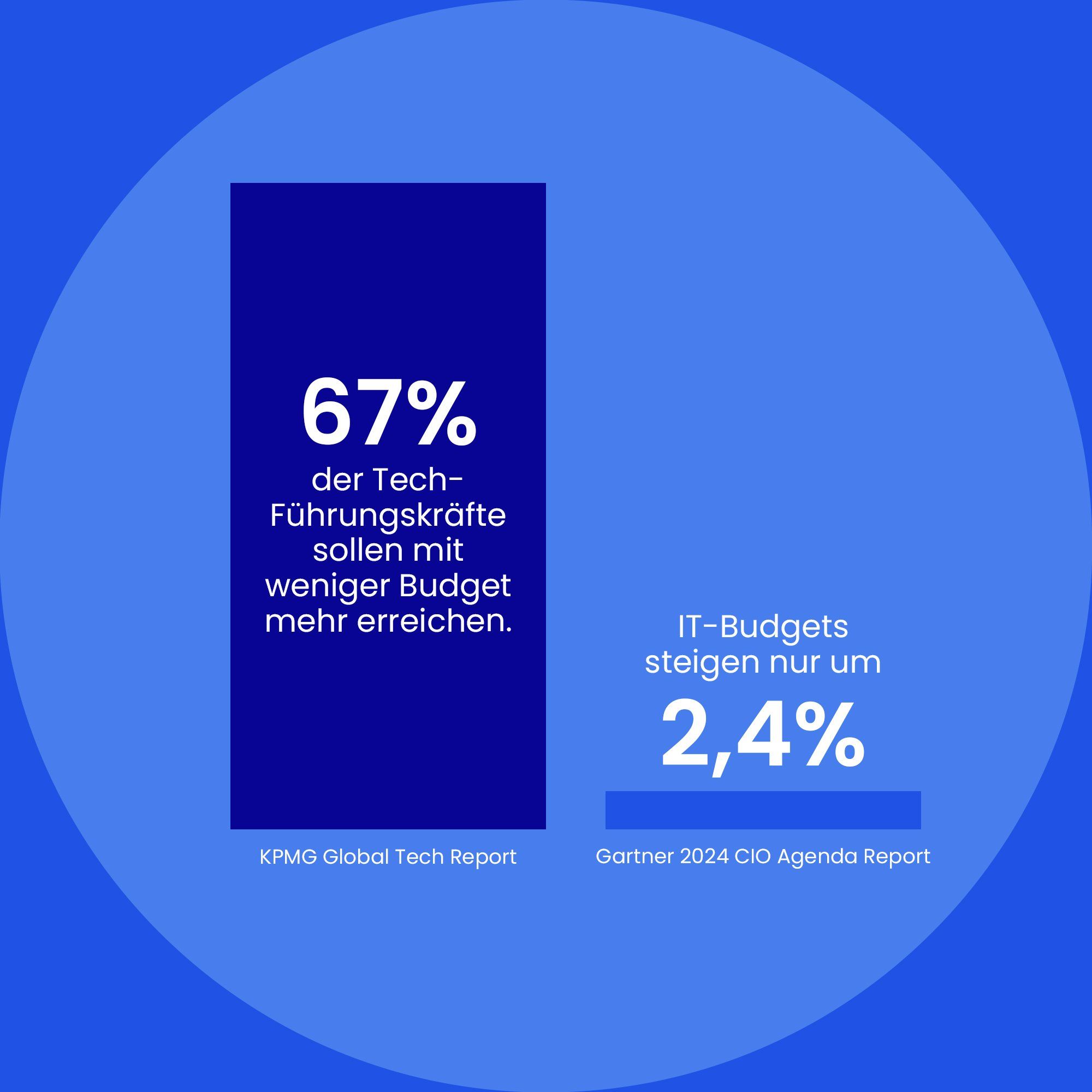

· DEMANDS ARE RISING 67% of IT owners have to achieve more with less budget (KPMG)

· BUDGETS ARE FLATLINING 2% growth in IT budgets – only a minimal increase (Gartner)

ZWISCHENHEADLINE LÖSUNG (kleiner Break in der Seite):

When acquiring new technology no longer entails an investment, it becomes an innovation. Individual IT leasing and lifecycle management make this a reality.

Turn your finance strategy into an innovation strategy – with the right IT.

Beispiel-Module (Bild-Text-Kombination):

Sale and leaseback: Free up capital without forgoing anything

Many businesses are sitting on IT hardware running into the millions of euros – tied-up capital that blocks liquidity. Sale and leaseback involves selling your current devices and leasing them straight back. This keeps the technology in use and streamlines your balance sheet, thereby giving you instant financial leeway. This allows you to create headroom for innovation without interrupting day-to-day operations.

A Financial Engineer’s Guide

Unlock liquidity strategically – e.g. through sale-and-leaseback and contract optimization

Existing hardware can be easily converted into available capital: sell, lease back, and create capacity for investment. This shift from CapEx to OpEx and regular fine-tuning of contracts makes budgets more predictable and eases pressure on the balance sheet.

Deploy budgets where they have the biggest leverage effect.

Scarce resources can be channeled into strategic fields such as AI, security, and transformation. Flexible leasing models offer tax advantages, financing with no impact on the balance sheet, and a reliable basis for long-term planning.

Create full transparency for financial control, reporting, and management.

Contracts, maturities, costs, and CO₂ data can be managed centrally and analyzed at any time. Real-time data provides a solid basis for informed budgetary planning, TCO calculation, and CSRD-compliant ESG reporting.

Convince financial decision-makers with verifiable figures

Less capital commitment, stable cash flow, and clear residual value models make for transparent cost structures. Finance and investment decisions can be robustly backed up with facts.

Summary-Box:

Financial engineering means making liquidity, scalability, and capacity for innovation manageable, without compromising on profitability, transparency, or technology. Circular tech provides the structured framework needed to do so.

Please get in touch to arrange a no-obligation consultation!

Find Out More

Testimonials

Learn how PENNY Italia managed to upgrade 10,000 IT devices economically using flexible IT leasing.

Testimonials

Learn how PENNY Italia managed to upgrade 10,000 IT devices economically using flexible IT leasing.

Industry Insight

Discover how to take your 2025 IT strategy to the next level in our TECHTALK webinars.

Industry Insight

Discover how to take your 2025 IT strategy to the next level in our TECHTALK webinars.

Employer Branding

Productivity also stems from employee satisfaction, which is why you need to focus on the right benefits.

Employer Branding

Productivity also stems from employee satisfaction, which is why you need to focus on the right benefits.